Eight affordable housing projects totaling 950 units stand to receive $33 million in public and private investment under a plan Charlotte officials are recommending to the City Council.  The proposals — six new developments and two renovation projects — would receive $12.8 million from the public Housing Trust Fund, $4.9 million in city-owned land and nearly $5 million in reduced interest, as well as $10.4 million from the private Charlotte Housing Opportunity Investment Fund in the ongoing effort to build or preserve affordable housing.

The proposals — six new developments and two renovation projects — would receive $12.8 million from the public Housing Trust Fund, $4.9 million in city-owned land and nearly $5 million in reduced interest, as well as $10.4 million from the private Charlotte Housing Opportunity Investment Fund in the ongoing effort to build or preserve affordable housing.

The twin $50 million public and private funds are designed to work together to build or renovate affordable housing projects. Pamela Wideman, Charlotte’s director of housing and neighborhood services, told council members Monday that public money in the proposed deals stretched further than previous projects, thanks to new complementary private dollars. “You have more partners, more skin in the game,” Wideman said, noting funding from the private fund and inclusion of housing vouchers in some deals. “That means you, the Housing Trust Fund, have to put fewer dollars in because of the dollars you have from the other partners.”

On average, each unit will cost about $18,000 to build or refurbish, compared with $30,000 per unit in previous deals that the trust fund financed. The two multi-family units contribute to an effort to save so-called “naturally occurring affordable housing,” or NOAH. Across the eight proposals, 21% of units are priced for households earning 30% of area median income, or AMI, while 11% are priced for above 80% AMI or unrestricted on income. The remaining 68% of units fall in the 30-80% AMI range.

Voters in November approved $50 million in bonds for the public fund. The private fund has raised $44 of its $50 million goal, according to Foundation for the Carolinas, which is raising the money.

The recommended projects are:

- 7th Street Apartments, developed by Laurel Street Residential, requested $1.5 million from the city fund, nearly $3.2 million from the private fund and $1.3 million in city-owned land to build 100 units, of which 20 are priced for 30% AMI or below. Rents range $420 – $2,225.

- Abbington on Mt. Holly, developed by Rea Ventures Group, LLC, requested $2 million from the city fund and nearly $1.8 million from the private fund to build 102 units, 26 of which are priced for 30% AMI or below. Rents range $553 – $1,459.

- Evoke Living at Westerly Hills, developed by Charlotte Housing Authority subsidiary Horizon Development Properties and Crosland Southeast. The project requested $2 million from the city fund and nearly $3.2 million from the private fund to build 156 units, of which 31 are priced for 30% AMI or below. Rents range $377 – $1,543.

- Owners of Heritage Park Apartments requested $600,000 from the city fund to upgrade 151 units, of which 50 are priced for 30% AMI or below. The remaining units are priced for 51-60% AMI. Rents range $826 – $1,230.

- North Tryon Homes, developed by NRP Group LLC, requested $2 million from the city fund and nearly $3.8 million in reduced interest to build 188 units, of which 38 will be priced for 30% AMI or below. Rents range $427 – $1,648.

- South Village Apartments @ Scaleybark, developed by the Charlotte-Mecklenburg Housing Partnership, requested $3 million from the city fund, $1 million from the private fund, $1.2 million in reduced interest, and nearly $2.6 million in city-owned land to build 82 units, of which 16 are priced for 30% AMI or below. Rents range $350 – $1,925.

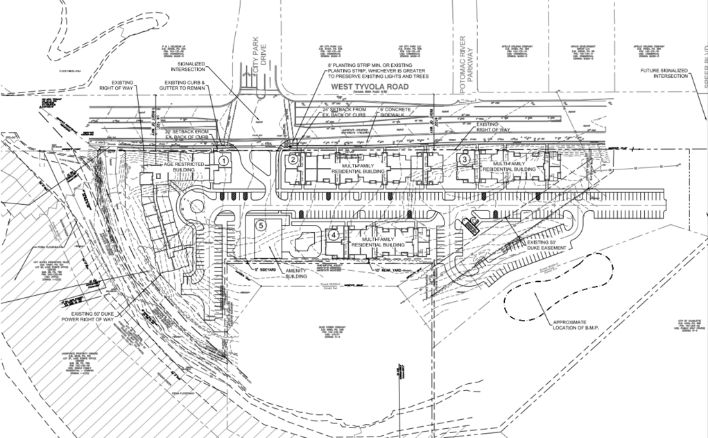

- Tyvola Road Apartments, developed by Laurel Street Residential, requested $980,000 in city-owned land to built 80 units, eight of which are priced at 30% AMI or below. Rents range $897 – $1,400.

- Charlotte-Mecklenburg Housing Partnership requested $1.7 million from the city fund and $1.33 million from the private fund for upgrades to 91 units at Wendover Walk Apartments,where nine are priced for 30% AMI or below. Rents range $785 – $1,010.

Several council members requested an explanation for why projects were recommended or discarded. Six proposals were not recommended to move forward. Councilman Justin Harlow, a Democrat representing District 2, noted some of the rejected deals had a higher percentage of units with rents priced for the lowest income levels. Council members will meet with housing department officials again July 15 before they are expected to vote on the recommendations July 22.